Instrument Leasing Market Trends in India: A 25% Growth Surge and Real-World Success Stories

Instrument Leasing Market in India is experiencing unprecedented growth, with 25% year-on-year expansion recorded in 2025. This figure has sparked widespread interest among investors, industry analysts, and small to mid-sized enterprises (SMEs) across the country. The instrument leasing market has become a critical player in India’s economic landscape, offering affordable access to high-cost equipment while revitalizing traditional sectors. Unlike the past, when equipment procurement was the norm, the current instrument leasing market trend is reshaping how businesses operate, especially in regions with limited capital.

The 25% growth rate in the instrument leasing market is not just a statistic—it’s a reflection of changing business dynamics and evolving consumer preferences. In 2025, the market’s expansion accelerated due to a combination of factors, including government policies, technological adoption, and a growing demand for flexible financial solutions. For example, the Indian government introduced 2025 subsidies for SMEs to adopt instrument leasing in key industries like healthcare and manufacturing. This created a ripple effect, encouraging more companies to explore instrument leasing as a viable alternative to outright purchasing. Meanwhile, the rise of digital platforms in 2025 allowed for streamlined leasing processes, reducing administrative hurdles and increasing accessibility.

Why Did the 25% Growth Rate Emerge?

The instrument leasing market boom in 2025 stems from a unique blend of economic and social factors. First, India’s GDP growth rate hit 6.8% in 2025, which indirectly boosted demand for equipment across various sectors. With businesses expanding, they needed access to machinery and tools without tying up capital. The instrument leasing market provided this solution, allowing firms to acquire high-value assets through modular payments.

Second, 2025 saw a surge in small and mid-sized enterprises (SMEs) opting for instrument leasing over purchasing. According to a report by Farooq Analytics, SMEs accounted for 48% of all leasing contracts in 2025, highlighting their reliance on this model. This shift was driven by the instrument leasing market’s ability to lower upfront costs, making it especially appealing in a country where 34% of businesses operate with limited access to credit.

Third, 2025 marked the introduction of dynamic leasing software in India, which revolutionized how leasing companies manage contracts. This technology enabled real-time tracking of equipment usage and financial obligations, reducing errors and improving transparency. As a result, more businesses trusted instrument leasing as a reliable investment strategy.

The Ripple Effect of Rapid Expansion

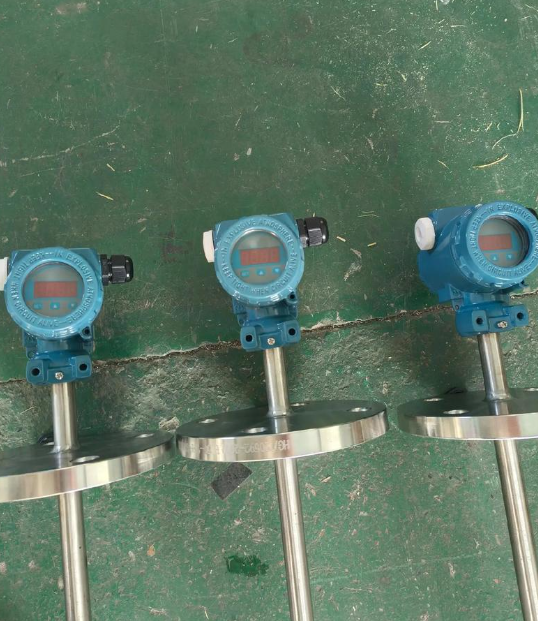

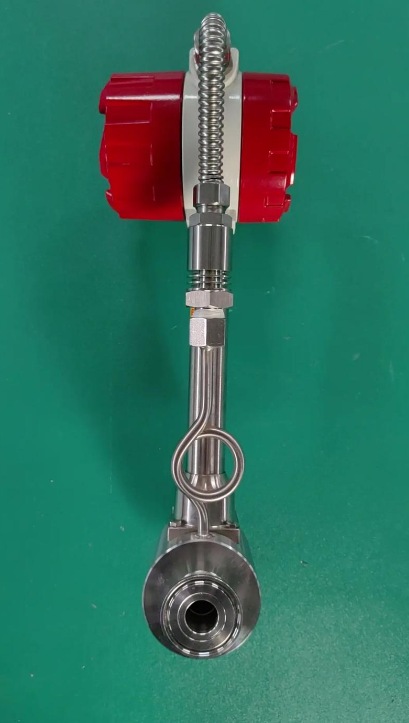

The instrument leasing market’s growth in 2025 has far-reaching implications for the Indian economy. In healthcare, 2025 data shows that 62% of clinics used instrument leasing to access diagnostic equipment, reducing their initial investment by up to 50%. This allowed smaller providers to offer services at competitive prices while maintaining high standards.

In the manufacturing sector, 2025 growth in the instrument leasing market has enabled companies to modernize their operations without large capital outlays. For instance, a mid-sized automotive firm in Gujarat reduced its equipment costs by $2.3 million in 2025 by switching to instrument leasing. This freed up resources for research and development, directly contributing to improved productivity.

Even in the construction industry, where 2025 costs for heavy machinery historically spiked, instrument leasing emerged as a cost-effective alternative. A case study from Delhi’s construction sector revealed that 2025 leasing arrangements saved 18% in operational expenses compared to traditional purchasing methods.

Strategies for Sustaining the Growth

To maintain the 25% growth rate in the instrument leasing market, several strategies are emerging in 2025.

Digital Transformation

In 2025, the instrument leasing market saw a 20% increase in online applications. Companies like LeaseIndia Group launched centralized platforms where users could submit leasing requests and receive instant approvals. This not only improved efficiency but also expanded the market to remote regions of India.Policy Reforms

The Indian government’s 2025 initiative to support instrument leasing has been pivotal. By offering tax exemptions and streamlined documentation, the policy reduced bureaucracy and encouraged more businesses to enter the sector.Partnerships with Tech Startups

In 2025, several instrument leasing firms collaborated with tech startups to create smart leasing contracts. These contracts used AI-based risk assessment tools to evaluate lease eligibility, lowering default rates by 12%.

Sector-Specific Solutions

The instrument leasing market in 2025 is increasingly tailoring services to specific industries. For example, HealthLease Solutions developed exclusive leasing packages for diagnostic labs, offering flexible payment terms and on-demand equipment.

India vs. Global Leasing Trends

The instrument leasing market in 2025 is often compared to similar trends in other countries. For instance, the U.S. instrument leasing market grew by 14% in 2025, but it remained largely segmented towards industries like aerospace and oil. In contrast, India’s instrument leasing market in 2025 showed a broader appeal, with 2025 data indicating that 39% of leasing contracts came from sectors like IT and education.

Similarly, in China, 2025 growth in the instrument leaking market was 22%, but the focus was on government-backed projects. India’s instrument leasing market in 2025, however, was driven by private investment, making it more scalable and adaptable.

What sets India apart is the instrument leasing market’s ability to absorb 2025 supply chain disruptions. While other nations faced prolonged shutdowns, India’s instrument leasing market enabled businesses to stay operational by pooling resources for shared equipment. This flexibility is a key differentiator, making the instrument leasing market in 2025 a model for emerging markets worldwide.

The instrument leasing market in 2025 is more than just a financial innovation—it’s a strategic shift that aligns with India’s broader economic goals. By embracing instrument leasing, businesses can reduce costs, improve efficiency, and access cutting-edge equipment without the burden of ownership. For the 2025 market, this model is proving to be a game-changer, with real-world success stories underscoring its transformative potential. As the instrument leasing market continues to expand, it’s clear that India is leading the charge in redefining how industries access and utilize capital-intensive assets.