Analysis of Investment Value in the Instrumentation Industry: A Guide to Understanding Market Dynamics

Investment in the instrumentation industry is an increasingly popular avenue, driven by advancements in technology and growing demand in sectors such as healthcare, manufacturing, and environmental monitoring. The instrumentation industry encompasses a wide range of products and services, from precise measurement tools to automated systems that help industries operate more efficiently. Understanding the investment value in this field requires a comprehensive analysis of market trends, technological advancements, and competitive dynamics. This article will explore these factors to provide a clear guide for potential investors.

Market Trends and Technological Advancements

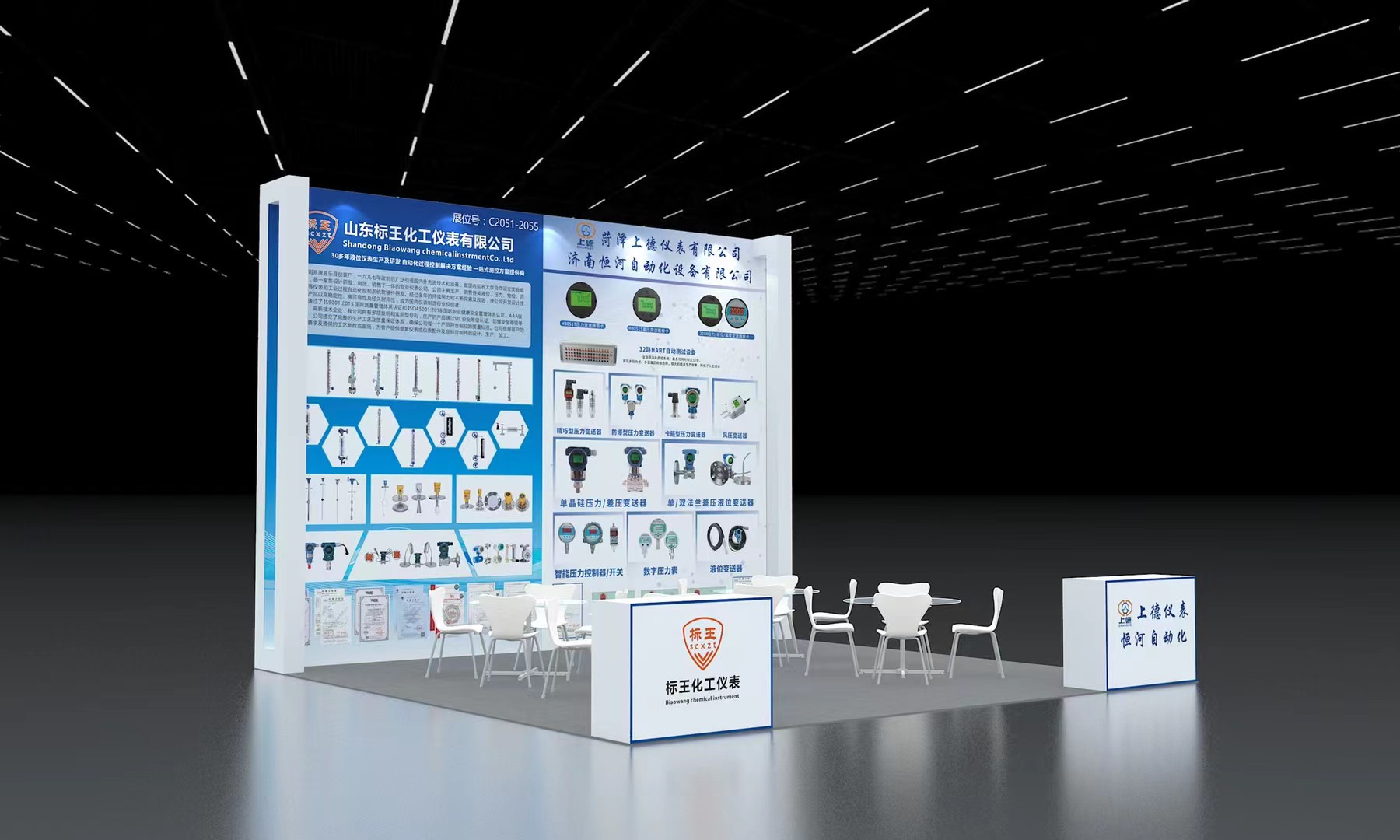

Market trends in the instrumentation industry are marked by a robust demand, particularly from emerging industries that rely on precise data collection and analysis. According to recent studies, the global instrumentation market size is projected to grow significantly by 2025. Key players in the industry, such as Emerson, Yokogawa, and Honeywell, are constantly innovating to meet these demands. For example, advancements in IoT and AI technologies have led to the development of smart sensors and real-time data analytics, which are revolutionizing how industries manage and interpret data.

Optimizing the Investment Strategy

To optimize investment in the instrumentation industry, it is essential to understand the underlying economic drivers and the competitive landscape. Optimization of Investment Strategy involves three key steps: Market Analysis, Technology Evaluation, and Financial Projections.

Market Analysis: Involves identifying target industries and regions. Industries like automotive, pharmaceuticals, and agriculture have shown strong adoption of advanced instrumentation technologies. Regions with growing manufacturing bases, such as Southeast Asia and Africa, also present significant opportunities. Analyzing these markets can help investors identify where their products will be most in demand.

Technology Evaluation: Evaluating current and emerging technologies is crucial. For instance, IoT and 5G technologies are enabling more seamless integration and real-time data transmission. Companies that can adapt quickly to these technological shifts will likely gain competitive advantages. Reviewing patents and research publications can provide insights into trending technologies and future innovations.

Financial Projections: Financial models are essential for assessing the profitability and scalability of investments. Historically, the instrumentation industry has shown steady growth driven by continuous technology investments and increased demand for efficient industrial processes. Investors should use financial models to predict revenue streams and assess the return on investment over time.

Performance Enhancement Through Implementation

The performance enhancement of investment strategies in the instrumentation industry can be greatly improved by several implementation methods. Firstly, .collaborative partnerships with leading manufacturers and research institutions can provide accelerated innovation and access to cutting-edge technology. Secondly, sustainable practices ensure long-term viability by aligning with environmentally friendly technologies and regulatory standards. Thirdly, customer-centric approach enhances market penetration by offering tailored solutions that address specific industry needs.

Case Studies: Success Stories

To further illustrate the benefits of a well-structured investment strategy, let's examine two case studies. Case 1: NESTA Sensor Solutions - This company focused on developing advanced sensors for the automotive industry. By leveraging AI and machine learning, they created a system for predictive maintenance that significantly reduced downtime and increased vehicle efficiency. Their investment in R&D led to a 30% growth in revenue over the past three years.

Case 2: TechVentures Industrial Systems - This company invested in IoT and smart grid technology for the energy sector. They partnered with major energy providers to implement real-time monitoring and automation systems. As a result, they saw a 45% increase in shareholder value within five years, driven by operational efficiency and cost savings.

Conclusion

Investing in the instrumentation industry can be highly rewarding, particularly for those who can navigate complex market dynamics and technological trends. By prioritizing market analysis, technology evaluation, and financial projections, investors can position themselves for success. Real-world examples such as NESTA Sensor Solutions and TechVentures Industrial Systems showcase how targeted strategies can lead to significant growth and profitability.

Understanding the intricacies of the instrumentation market not only provides investors with a strategic edge but also contributes to the broader adoption of advanced technologies that drive efficiency and innovation in various industries.